How to Use Your FSA for Vision Correction Surgery

One of the biggest concerns for those considering LASIK surgery, or other vision correction surgery, is the cost. Most insurance companies consider LASIK an elective procedure because you can just wear glasses or contacts. Because they consider the procedure elective, they typically will not cover the cost. Vision correction surgery can carry an expensive up-front cost, but when you consider the years that you’ll be paying for glasses, contacts, and all the things that go along with that, LASIK surgery can save you money. It’s important to find payment options that will help you live life without lenses.

While we offer several payment options at Kleiman Evangelista Eye Centers, you may be able to offset your costs even further with a flexible spending account or FSA.

What is an FSA?

A healthcare FSA, or flexible spending account, is an employer-sponsored, pre-tax savings account. Each year, you can contribute a fixed amount to cover eligible medical expenses, including deductibles, copayments, prescriptions, and, yes, even LAISK surgery.

It’s important to remember that with an FSA, you must use all available funds by the end of the year, or your FSA dollars will expire. Depending on your employer, you may have a few options that allow you to take advantage of your FSA funds after the typical expiration period:

- 2-½ Month Grace Period – In this case, you will maintain access to your FSA dollars until March 15th of the following year, giving you time to put them to use.

- $500 Rollover – While you will not have access to all your funds, you will be able to rollover $500 to go toward costs in the following year.

Keep in mind that your employer can only offer one of these options, not both. So, it’s important to know which one applies to your FSA account and plan accordingly.

3 Benefits of an FSA

When it comes to choosing between an FSA vs. HSA, a few key benefits may make one option more appealing for you.

1. You don’t need insurance to have an FSA.

Unlike an HSA, you don’t need to enroll in insurance to have an FSA account. However, your employer does need to offer an FSA benefit. On the opposite end, you can also have multiple insurance plans and still contribute to an FSA.

2. You receive full access to funds at the beginning of the year.

While you will contribute to your FSA throughout the year via payroll deductions, you will have access to the total amount of funds at the beginning of the year before you’ve even contributed. This does mean that you will only have one opportunity a year to enroll and decide how much you’d like to set aside in your FSA account so it’s important to plan.

3. You use pre-tax dollars.

FSA contributions are taken out of your paycheck prior to any tax deductions s you don’t pay taxes on the funds in your FSA. Meaning more money for you to spend on your medical expenses.

Can I spend my FSA on vision correction surgery?

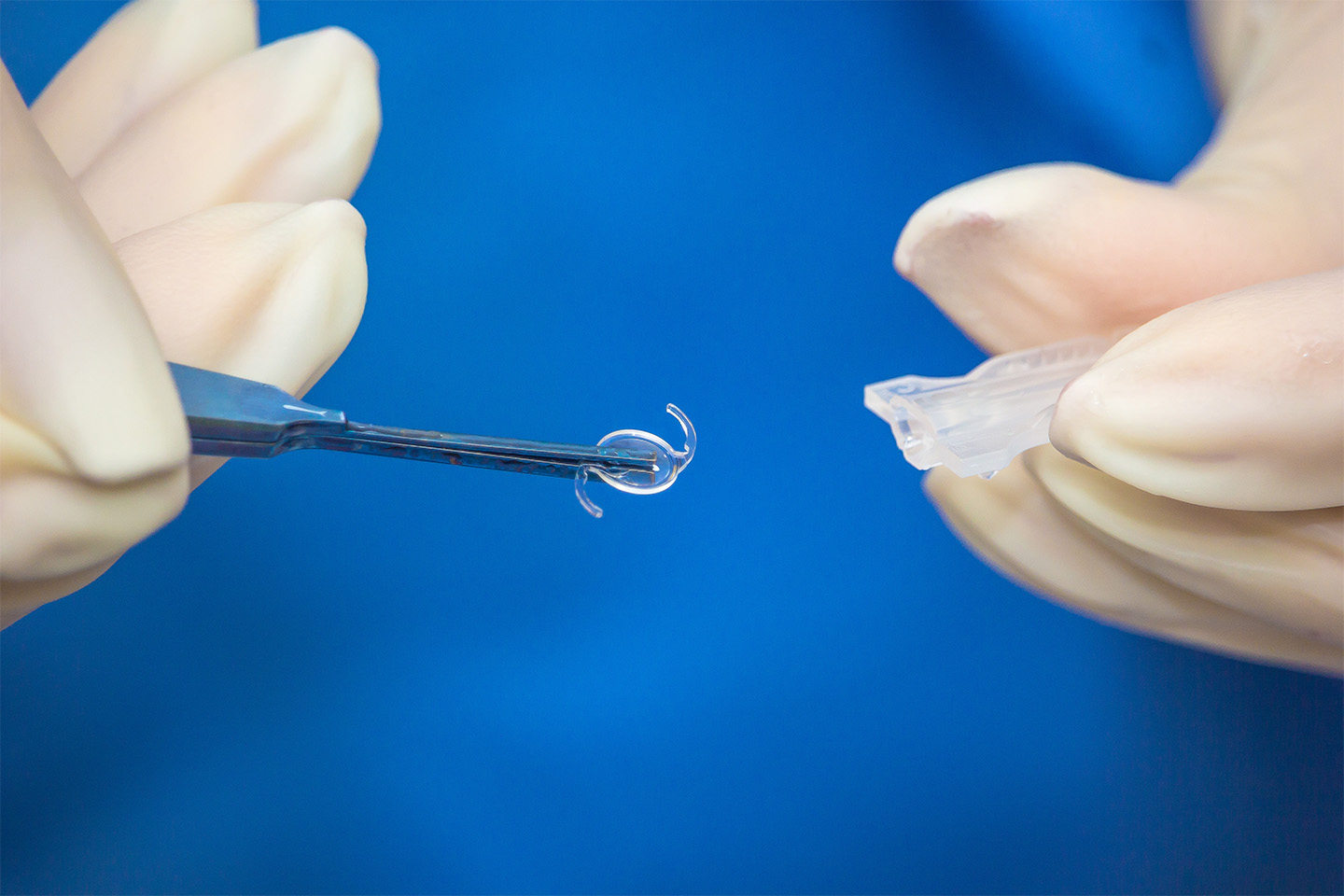

Yes, you can use your FSA account to pay for LASIK and other vision correction surgery, like PRK, Visian ICL, and Clear Lens Exchange.

How does it work?

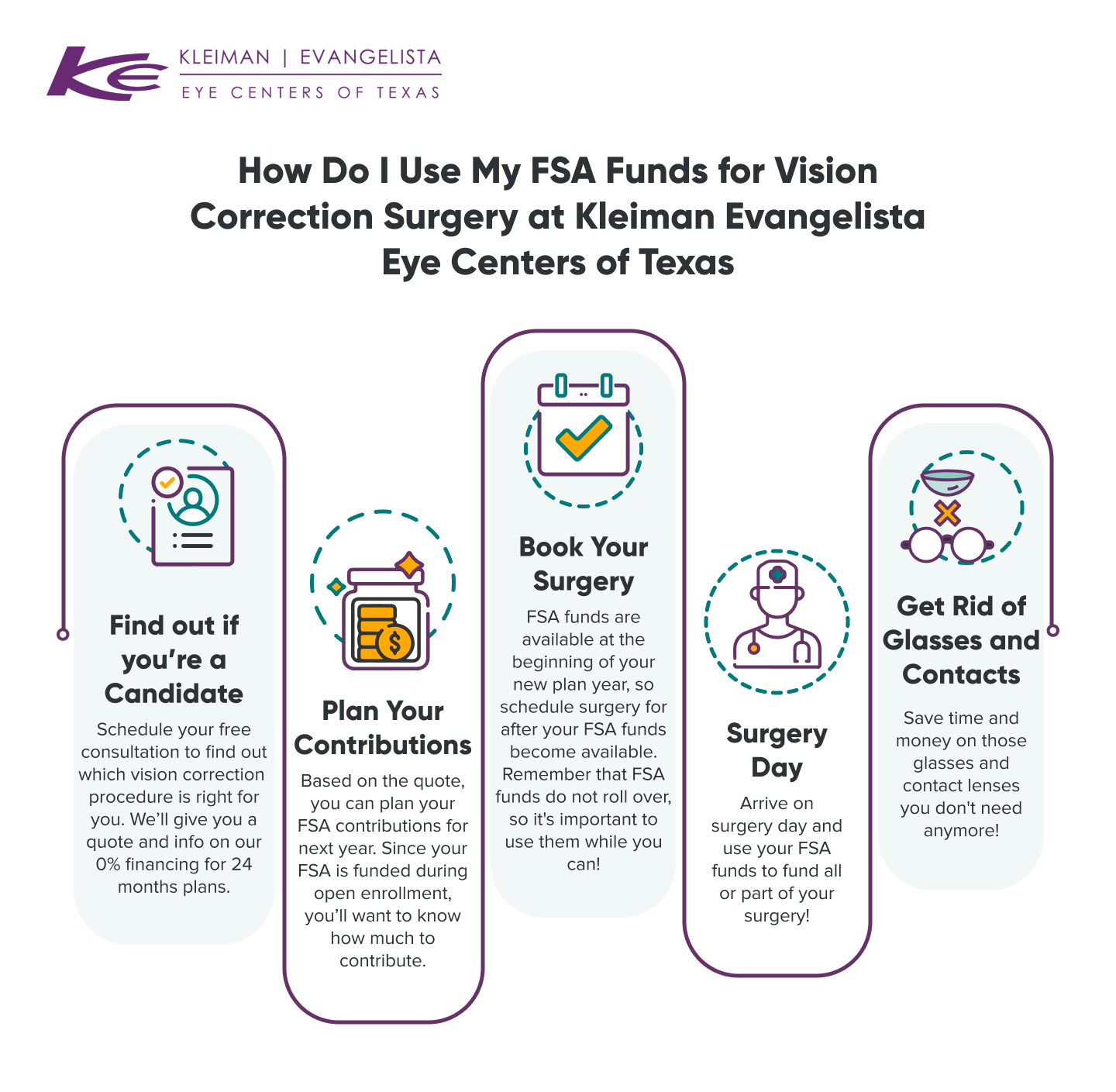

It’s important to plan ahead to be able to get the full benefit of using your FSA dollars for vision correction surgery. The first step is to come in for a free consultation. Once our eye doctors have determined which vision correction surgery may be best for you, you’ll speak with a team member who will be able to give you a personalized quote for your procedure. That quote will also consider any insurance-based discounts or relevant information.

The next step is to plan your FSA funding for the following year to ensure you can cover as much of your LASIK surgery as possible. Since you will have access to you FSA funds immediately, you can schedule your surgery whenever you like after your FSA funds become available.

On your surgery day, paying for your LASIK surgery using your FSA works very similarly to paying with a debit or credit card, especially if you’ve been issued an FSA debit card. If not, you may need to submit your receipt for reimbursement, so remember to keep all related documents.

Key Takeaways:

- An FSA is a tax-advantaged account that can be used to fund to pay for approved medical expenses, including LASIK or other vision correction surgery.

- The funds in your FSA account expire at the end of each year unless your employer offers a rollover or grace period option.

- All FSA funds become available at the beginning of the year and can be combined with the previous year’s funds (if applicable) to pay for your LASIK surgery.

- Because insurance will not pay for LASIK, you can use your FSA account to pay for LASIK surgery and other laser vision correction surgery.

Don’t let paying for LASIK stop you from achieving your vision goals. Laser vision correction surgery is a sound investment in yourself and can cut down on a lifetime of other vision costs. Schedule your free consultation with our eye doctors in the Dallas metro area to determine your candidacy and create a payment option that suits your needs.