How to Use Your HSA for Vision Correction Surgery

Are you considering getting vision correction surgery? Payment may be one of your top concerns since procedures like LASIK surgery are typically not covered by insurance. What you may not know is that you can use your Health Savings Account (HSA) to help cover the cost of LASIK or other vision correction procedure.

What is an HSA?

An HSA, or health savings account, is a tax-exempt bank account used to pay for out-of-pocket medical expenses that are not covered by your health plan. You can use an HSA to pay deductibles, copayments, coinsurance, and even prescriptions for your medical, dental, and yes even LASIK surgery.

Some employers offer HSAs and will even make contributions to your account. However, you may enroll in an account independent of your employer, meaning self-employed individuals can also reap the benefits of an HSA.

4 Benefits of an HSA

An HSA offers several benefits beyond paying for your vision correction surgery. When it comes to choosing between an HSA vs. FSA, the health savings account may appeal to you for several reasons:

1.It’s Tax Free

Any contributions made toward your HSA come from your pre-tax dollars. Not to mention, no taxes are taken on withdrawals—and if your money earns interest, that will not be taxed either.

So, you get the benefit of paying for LASIK and other medical costs with 20%-30% of pre-tax savings.

2.It’s Tax-Deductible

Any contributions you make to your HSA are tax-deductible. That means when tax season comes around, you pay less and/or receive a greater return because of your HSA payments.

3. Funds Roll Over

Instead of expiring at the end of the year, all your HSA funds will roll over, making this a more appealing option than an FSA. Plus, if you happen to change jobs at any point, your HSA funds will come with you.

4. You can invest funds

If you don’t anticipate using some of your HSA dollars, you can invest it and continue to grow your money tax-free. Many people will use this option to boost their retirement fund. Always speak to your financial advisor before making investments.

Can I spend my HSA on vision correction surgery?

Yes! The IRS classifies LASIK, PRK, and other vision correction procedures, like cataract surgery, as eligible medical expenses.

How does it work?

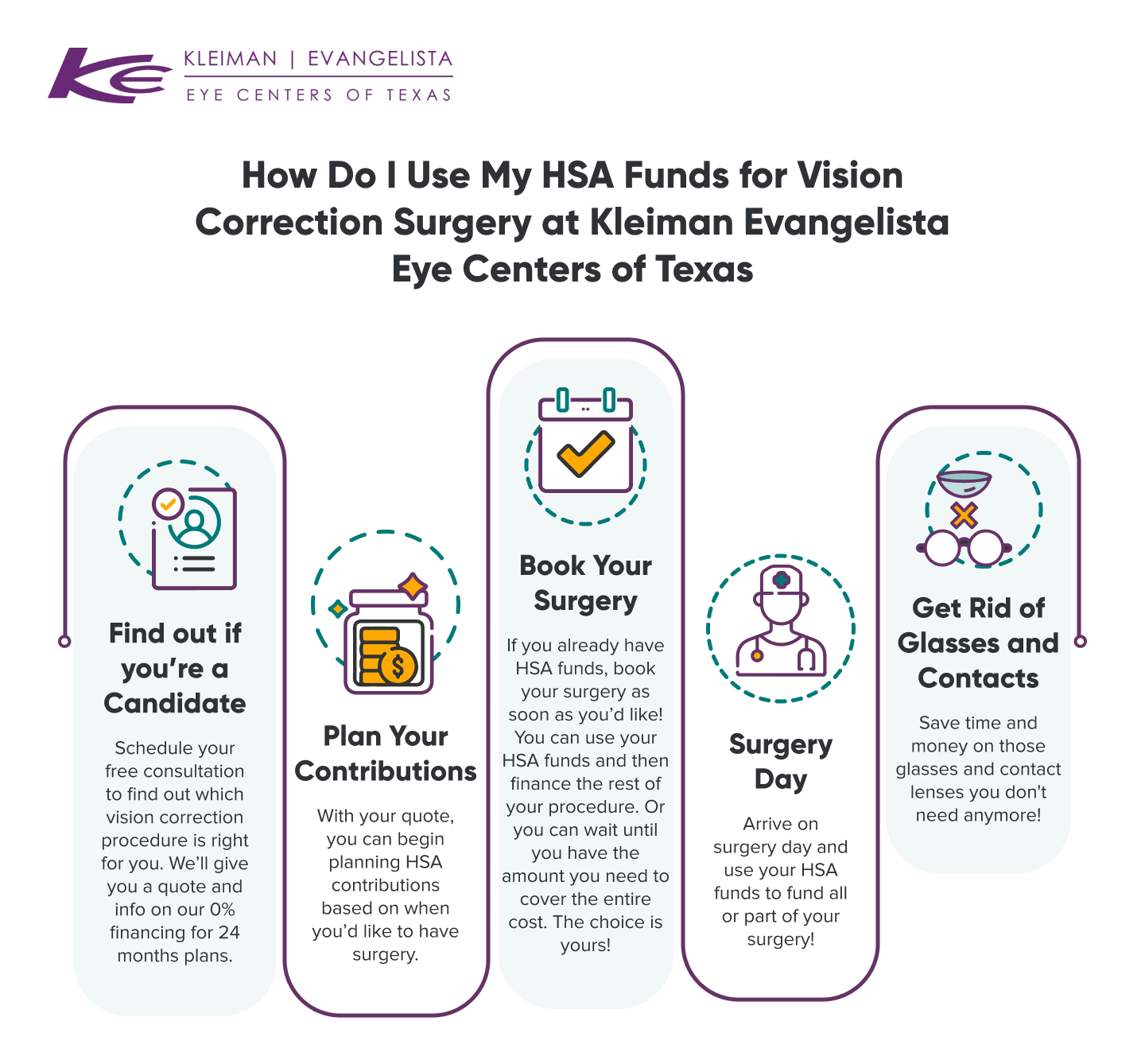

The first step of using your HSA funds to pay for your vision correction surgery is to find out if you’re a candidate and learn which vision correction procedure is right for you. Kleiman Evangelista offers LASIK, PRK, Visian ICL, and Clear Lens Exchange as well as corneal cross-linking and refractive cataract surgery. During your free consultation, our team of eye doctors will talk with you about what’s best for your vision and explain the costs associated with your chosen surgical treatment.

After you know which vision correction procedure is right for you, it’s time to start planning your HSA contributions. Since HSA funds can be contributed at any time and roll over annually, you can plan for vision correction surgery as soon as you’d like.

There are a couple of things to be aware of when planning your HSA contributions:

- You only have access to money as you contribute to the account.

- You can use existing HSA funds as a sort of down payment on your vision correction procedure and then finance the remaining balance. Kleiman Evangelista offers 0% financing for up to 24 months – saving you money!

- Thanks to the rollover benefit, another option is to save up your funds until you have enough to cover the entire cost.

Once you have the HSA funds you need, it’s time to schedule surgery!

On surgery day, you can use those HSA funds. The key to keeping the funds tax-free is to keep your receipts as documentation that the funds were used for covered expenses.

Key Takeaways

Planning ahead is the key to using your HSA funds to cover the costs of vision correction surgery. Understanding which vision correction procedure is right for you and how much that procedure that cost can help you plan your HSA contributions.

Don’t let the cost of LASIK stop you from a life of clear vision. Even if you don’t have an HSA, we offer 0% financing options at Kleiman Evangelista Eye Centers, with payments starting as low as $99 a month to keep your costs affordable.

Schedule your free consultation with our eye doctors in the Dallas metro area for your individualized treatment and payment plan.