FSA for Eye Health

As the year comes to a close and you start to look towards the year ahead, health and wellbeing are frequently top-of-mind. The end of the year marks a deadline for healthcare, and whether it is scheduling procedures before your deductible resets in the new year, or using up the remaining pretax dollars in your FSA, timing is important.

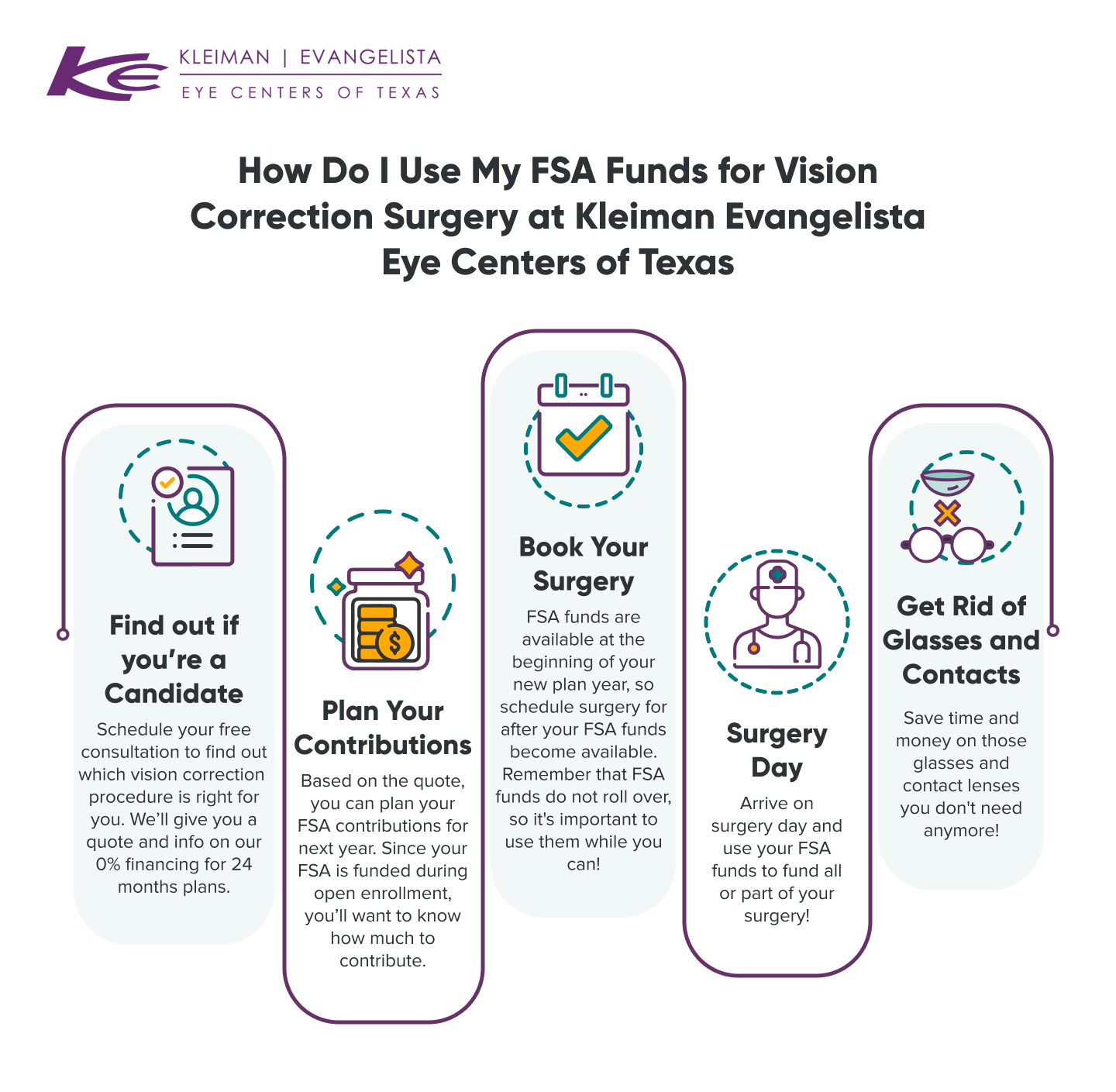

One of your priorities should be the consideration of eye and vision health. You can take advantage of health plan benefits, such as an FSA, to cover not only eye exams or treatments, but also more in-depth procedures, such as laser vision corrective procedures. Here at Kleiman Evangelista, our team is ready to help you access a range of affordable correction treatments and procedures with a range of financing options, including FSA funds, so you can enter 2023 with clear vision!

What is an FSA?

An FSA plan, or flexible spending account, is a special account that you put funds in to pay for out-of-pocket medical expenses. This employer sponsored healthcare benefit allows recipients to put up to the contribution limit of $3050 of their taxable income aside each year to use for qualifying healthcare expenses and is separate from health insurance or a health savings account.

Money is put into an FSA via pre-tax payroll deductions. This means that an FSA account functions basically as a tax-free savings account for medical expenses, saving you money on eligible expenses. Thousands of products and services are covered under FSAs, from crutches to copays.

The primary drawback of a Flexible Spending Account is the “use it or lose it” rule that states that the account holder must use all of the pre-tax funds in the account before the end of the year, or they are forfeited to the employer. There are a few ways to avoid this drawback of the plan. The first is the Carryover Rule, which allows account holders to carry over up to $610 of their unused pre-tax dollars from the previous year into their account for the following year. The second option for leniency is the Grace Period, in which an employer using a cafeteria plan can extend the end of year plan deadline by up to 2.5 months to allow account holders additional time in which to spend the unused FSA dollars. Both of these options are subject to employer policies, so it is always best to check with a company Human Resources advisor.

How to use your Flexible Spending Account

Luckily, using the funds in an FSA is easier than ever! An FSA works through reimbursement. This means that you submit a receipt for the qualifying product or service to the FSA through your employer, and they will reimburse your out-of-pocket expense from your allotted funds. Some plans have started offering an FSA debit card that will allow you to pay a balance from your account at the point of service. Most plans have an online portal that makes managing your account and claims simple.

An FSA can be used on a product or service that is designated by the Internal Revenue Service as “medical care”. Medical costs, as defined by the IRS, are the costs of diagnosis, cure, mitigation, treatment, or prevention of disease, and for the purpose of affecting any part or function of the body”. This wide definition allows for a lot of things to fall under the umbrella of “medical costs”.

FSA funds can be used to cover certain medical, dental, or vision expenses for spouses or dependents as well as out-of-pocket healthcare costs incurred by the account holder. It is important to check with your provider, as some FSAs have additional stipulations on reimbursements for non-account holders.

Can You Use FSA for Vision Correction Surgeries?

YES! Corrective eye surgeries and laser eye surgeries are eligible medical expenses. Multiple types of vision correction procedures qualify for FSA spending.

Can You Use Your FSA for LASIK?

Yes! LASIK is eligible for FSA reimbursement and is occasionally covered by some medical insurance plans and vision insurance plans. LASIK, laser assisted in situ keratomileusis, is one of the most well known and popular types of corrective eye procedures.

The LASIK procedure uses a laser to help reshape the cornea of the eye, allowing patients with myopia (nearsightedness), hyperopia (farsightedness), and astigmatism to have better vision without the use of corrective lenses such as prescription eyeglasses or contact lenses. To determine if you are a good candidate for the LASIK eye surgery, take our LASIK Self-Test and reach out to schedule an in-depth consultation at one of our six clinic locations across the DFW Metroplex and North Texas.

Can You Use Your FSA for Clear Lens Exchange (CLE)?

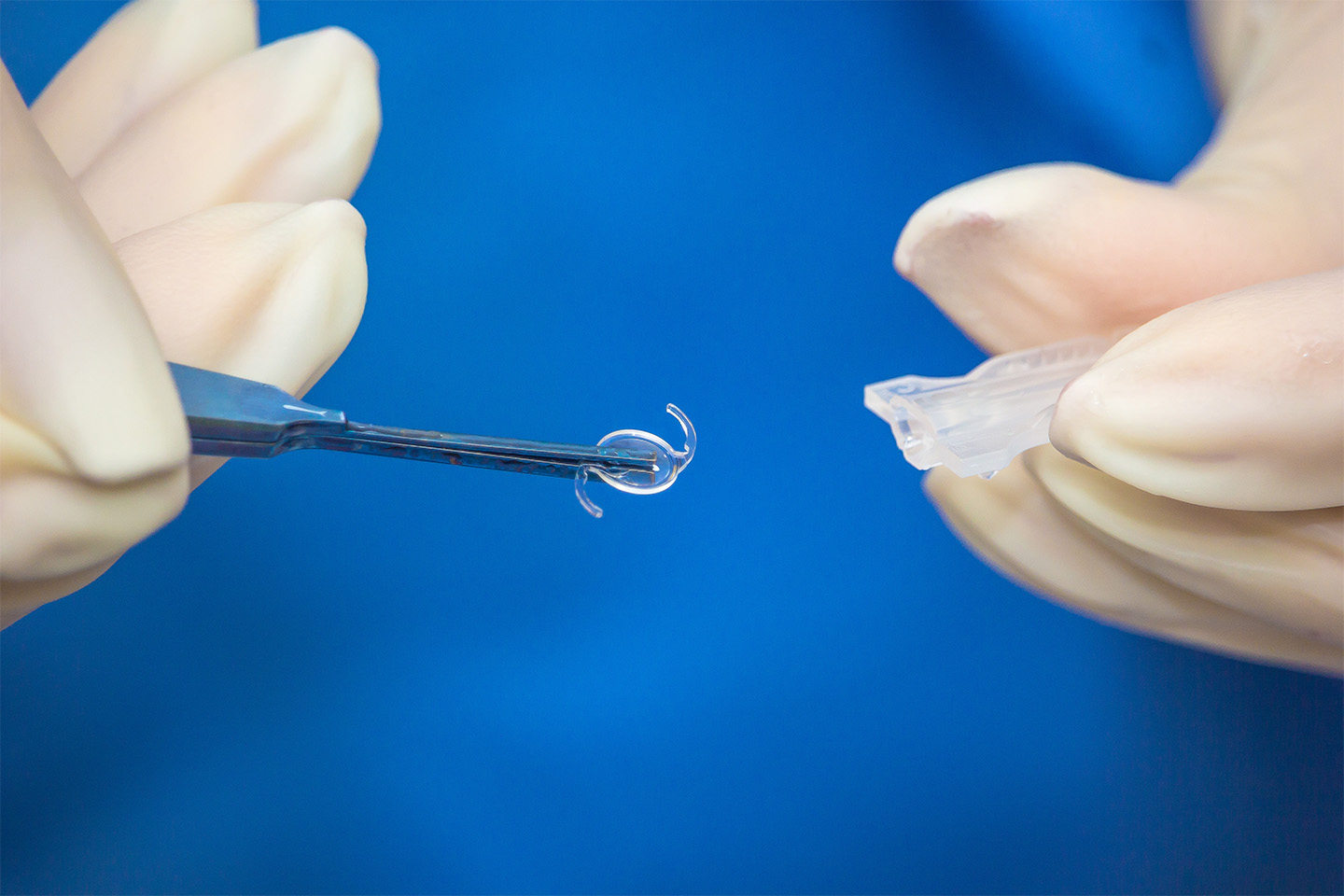

Yes! Clear Lens Exchange, or CLE, is eligible for reimbursement from your FSA. CLE is an elective procedure where the natural lens of the eye is removed and replaced with an artificial lens. This procedure is a great option for vision correction, but it is particularly beneficial for patients that are not good candidates for LASIK surgery, are over the age of 40, or patients that are developing early cataracts.

There are multiple lens options available, and the experts at Kleiman Evangelista are ready to work with you to determine the best option for your vision and lifestyle. To find out if you may be a candidate for CLE, schedule a free consultation with a doctor at Kleiman Evangelista.

Can You Use Your FSA for Cataract Surgery?

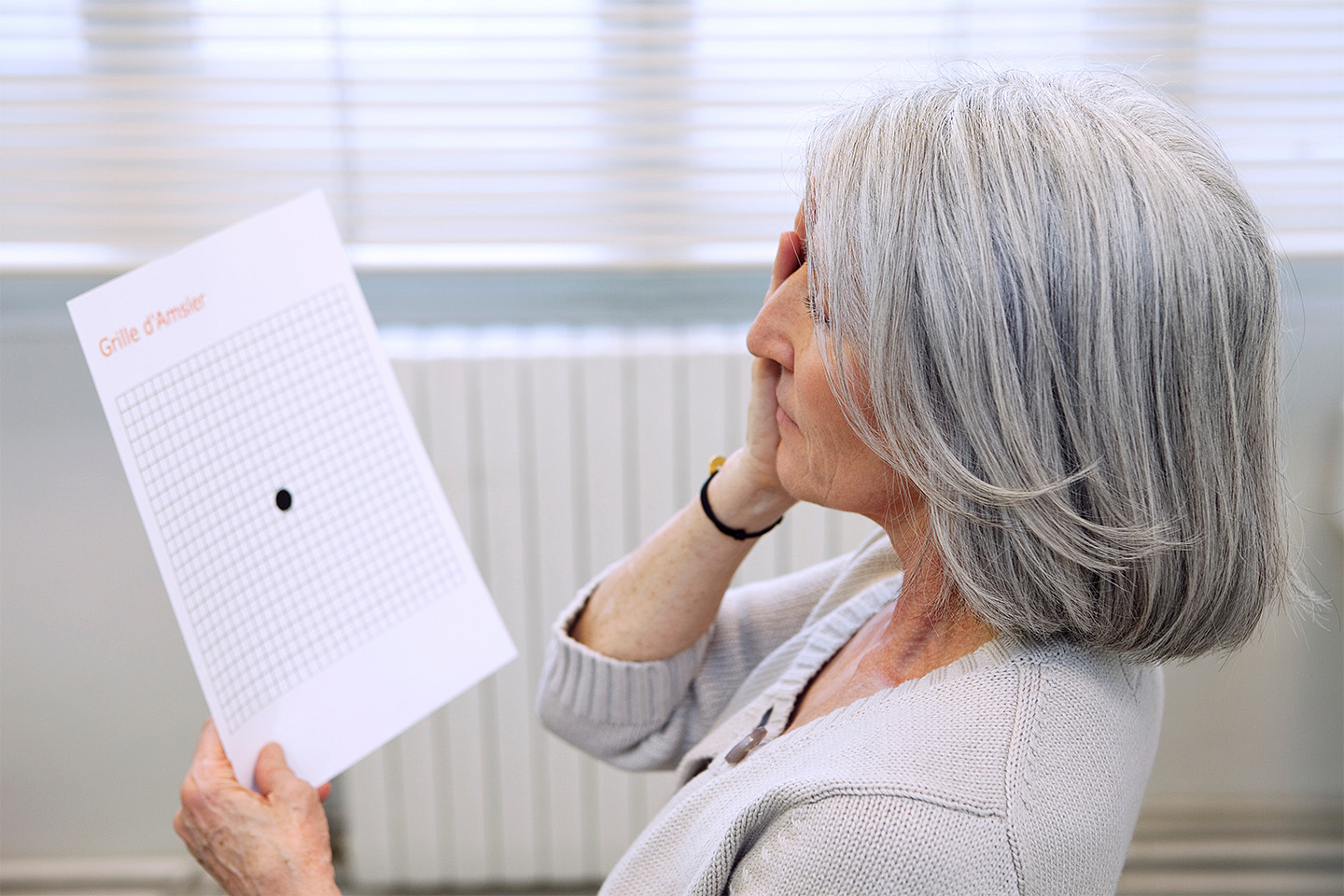

Yes! Cataract Surgery is a qualified medical expense for FSA reimbursement. Cataracts, while a normal part of aging, cause the natural lens of the eye to become increasingly cloudy. This impairment of vision starts slowly and progresses until it becomes a noticeable impairment. Cataract surgery is the only complete treatment for cataracts, replacing the damaged lens with an artificial intraocular lens (IOL).

At Kleiman Evangelista Eye Centers of Texas, our expert surgeons have extensive experience safely restoring vision to patients affected with cataracts via traditional and laser assisted surgeries. There are multiple lens options available that may reduce dependence on corrective lenses, such as glasses or contact lenses. Schedule a consultation with a Kleiman Evangelista surgeon to talk about your vision goals and better understand your options.

Can You Use Your FSA for EVO Implantable Collamer Lens (ICL)?

Yes! The EVO ICL procedure is eligible for reimbursement from your FSA. The EVO ICL is essentially a contact lens that is implanted in the eye, between the iris (the colored part of the eye) and the natural lens. This artificial lens works with the natural lens to correct vision issues without reshaping the cornea or removing the natural lens. This makes ICL a great procedure for patients with thin corneas, dry eyes, and moderate to severe nearsightedness with or without astigmatism.

The EVO ICL is meant to remain in place, so long as you are satisfied with your vision; however, if your vision changes, or you would simply like it removed, your surgeon can remove the lens without compromising your vision. To determine if you are a candidate for the Implantable Collamer Lens, schedule a consultation with one of the experts at Kleiman Evangelista.

What Does FSA Not Include?

Flexible Spending Accounts can provide reimbursement for many medical and medically-related expenses, however there are some things that it will not include. It is always best to check in with your specific plan provider to see if something will be covered or not, as it is subject to change from plan to plan.

An FSA will not usually provide reimbursement for insurance premiums unless specifically stated in the policy, but it will generally cover copays or specialist visits. There are a lot of stipulations with this type of reimbursement, and it varies from company to company based on procedure.

FSAs will not provide reimbursement for nonprescription drugs. With the exception of insulin, any drug that is not prescribed by a doctor will not be reimbursed. For example, your ophthalmologist recommends that you try some anti-itch eye drops during allergy season that you can pick up on the shelf of your local pharmacy. Because this medication does not require a prescription, this will not qualify for reimbursement.

Future medical services also will not be covered. This means that you can’t use the rest of this year’s FSA balance towards a procedure that you will be getting substantially into the next year. This rule does not apply in situations where future payments are for obtaining lifetime care, i.e. monthly or lump sum fees paid to retirement homes or long term care institutions.

Additional things that will not be reimbursed by an FSA include health club memberships, cosmetic procedures, maternity clothes, non prescribed nutritional supplements, weight loss programs not for the treatment of specific diseases, or childcare for normal, healthy babies, even if the parents are receiving medical care.

Take Advantage of Your Savings Before 2023!

KE encourages you to make the most of your FSA, and invest in your eyesight. You can use your savings on a transformative laser vision correction procedure such as LASIK, CLE, Cataract Surgery, or EVO ICL. Schedule a free consultation with our eye care professionals today to get started!